In recent years, the forex trading landscape has changed dramatically, all thanks to technological advancements and the popularity of mobile applications. Today, traders can access real-time data, execute trades instantly, and analyze market trends from their mobile devices. This shift from traditional trading methods to mobile platforms has made forex trading more accessible than ever. One notable platform in this area is trading forex app https://protradinguae.com/, which empowers traders with the tools they need to succeed in a competitive landscape. In this article, we explore the essential features that make a trading forex app stand out and how to choose the right one for your trading strategy.

Why Use a Forex Trading App?

The forex market operates 24 hours a day, meaning that traders need to remain vigilant to make the most of opportunities that arise. This necessity is where trading forex apps shine. Unlike desktop platforms that tether you to a specific location, a mobile app allows you to stay connected at all times, providing you with the freedom to trade on the go. Here are some key advantages of using a forex trading app:

- Accessibility: Access your trading account anytime, anywhere.

- Real-time data: Get instant access to market news and trends.

- Quick execution: Make trades in seconds without missing out on opportunities.

- User-friendly interface: Enjoy intuitive navigation and simplified processes.

- Advanced charting tools: Analyze market movements effectively with just a few taps.

Key Features of a Top Forex Trading App

When selecting a trading forex app, certain features are crucial for an efficient and productive trading experience. Below are some of the essential elements to look for in a top-notch trading platform:

1. User Experience (UX)

A stellar user experience is critical for any trading app. If an app is difficult to navigate or has a cluttered interface, it can lead to mistakes or missed trading opportunities. Look for apps that offer a clean design, straightforward navigation, and customizable dashboards to cater to different trading styles.

2. Security

Security is paramount in financial trading. Ensure that the app you choose uses encryption technology to protect your personal and financial information. Look for platforms that offer two-factor authentication (2FA) and comply with industry regulations to safeguard your investments.

3. Charting Tools and Technical Analysis

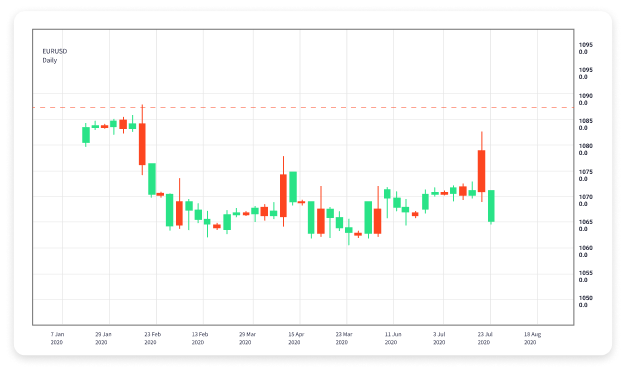

A forex trading app should include robust charting tools that allow users to analyze market trends and utilize technical indicators. These features enable traders to make informed decisions based on historical data and price movements.

4. Real-time Market Data

Being able to access real-time market data is essential for trading success. The app should offer live quotes, economic calendars, and news feeds to ensure that traders can react swiftly to market changes.

5. Order Types and Execution Speed

The best forex trading apps will provide various order types (market orders, limit orders, stop-loss orders, etc.) and ensure fast execution speeds to minimize slippage and maximize profitability.

6. Customer Support

Reliable customer support can be a lifesaver when technical issues arise or questions need answering. Check if the app offers 24/7 support through multiple channels, such as live chat, phone, or email.

Choosing the Right Forex Trading App

With numerous forex trading apps available, choosing the right one can be a daunting task. Here’s a step-by-step guide to help narrow down your options:

1. Define Your Trading Goals

Different traders have varying needs depending on their trading style (scalping, day trading, swing trading, etc.) and goals (profit targets, risk tolerance). Knowing what you aim to achieve can help you filter out unsuitable apps.

2. Read Reviews and Testimonials

Look for reviews from other traders about their experiences with specific apps. Authentic testimonials can provide insights into the strengths and weaknesses of a platform.

3. Compare Features

Make a checklist of the features you consider essential and compare different apps against this list. This process will help you identify which platform meets your needs best.

4. Take Advantage of Demo Accounts

Many trading apps offer demo accounts that enable you to test their features without risking real money. Use this opportunity to familiarize yourself with the app’s interface and determine if it suits your trading strategy.

5. Evaluate Costs and Fees

Different platforms may have varying fee structures, including spreads, commissions, and withdrawal fees. Ensure you understand all costs associated with the app to avoid unexpected expenses that could impact your profit margins.

Conclusion

The trading landscape has evolved with the emergence of innovative forex trading apps, making it possible for traders to operate efficiently and effectively from anywhere. By considering essential features, understanding your goals, and conducting thorough research, you can select the best trading forex app that aligns with your strategies. Whether you’re a beginner or an experienced trader, the right app can provide you with the tools and resources needed to navigate the complex world of forex trading successfully.